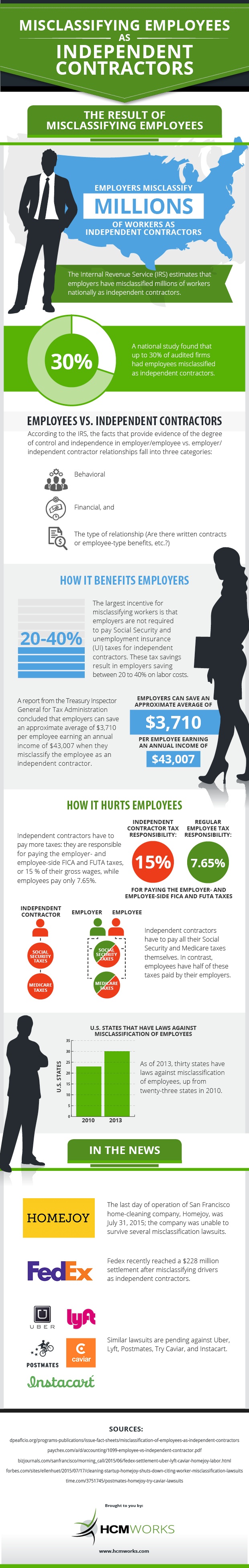

The misclassification of employees as independent contractors is so rampant across the country that the Internal Revenue Service (IRS) estimates there are literally millions of people in this current state. One national study found that 30% of audited firms had misclassified employees. There are three categories that provide evidence of the degree of control in employee/employer vs. employer/independent contractor relationships, according to the IRS. Those categories are: behavioral, financial, and the type of relationship.

The Cause

Even though it is against the law in 30 states as of 2013 (up from 23 in 2010) for businesses to do this intentionally, many still do. The main reason is, unsurprisingly, financial. Employers aren’t required to pay Social Security or unemployment insurance taxes for independent contractors, as they would if they were labeled as full-time employees. For an average employee making $43,007 a year, employers can save about $3,710 annually by misclassifying them as an independent contractor, according to a report by the Treasury Inspector General for Tax Administration. Overall, this can save a company between 20–40% on labor costs.

The Effects

As is normally the case, the burden ultimately falls on the little guy. Independent contractors have to pay more in taxes, as they are required to pay 100% of their FICA, FUTA, Social Security, and Medicare by themselves. Employees pay half of these taxes while their employers handle the other half.

The Consequences

Recently, many companies big and small have been severely punished for skewing the lines of these two statuses. For example, FedEx came to a $228 million settlement for misclassifying their drivers. The San Francisco-based home-cleaning company, Homejoy, was forced to close after they were hit with multiple misclassification lawsuits. Other companies such as Uber, Lyft, Postmates, and Instacart currently have pending lawsuits against them.

The moral of the story? There are no shortcuts in life. Give people the designation they deserve, or risk facing the wrath of Uncle Sam.